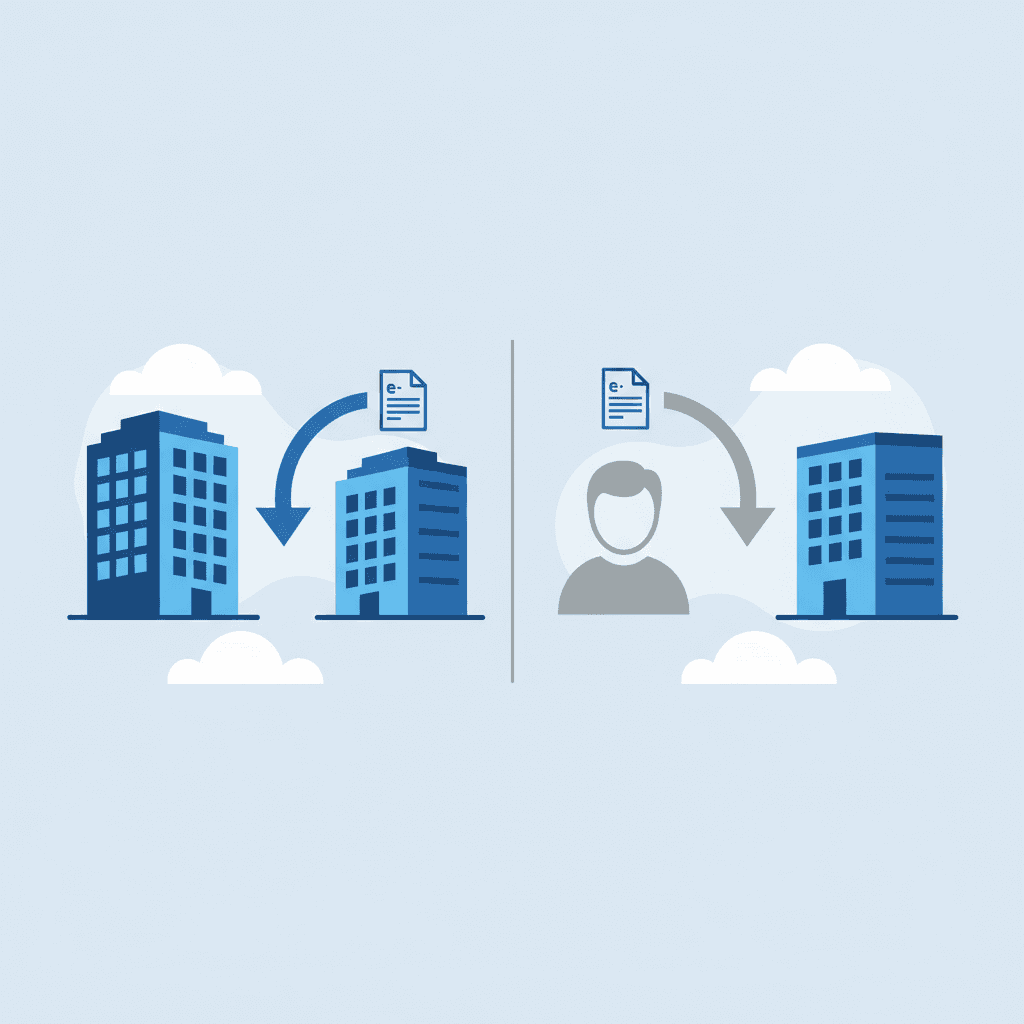

B2B vs B2C E-Invoicing: What's the Difference?

Belgium's e-invoicing mandate took effect on January 1, 2026. But it does not apply equally to all transactions. The rules for B2B (business-to-business) and B2C (business-to-consumer) invoices are very different. This guide explains exactly what applies to your situation.

The short version

- B2B invoices: Must be sent via Peppol since January 1, 2026. This is mandatory for all VAT-registered Belgian businesses.

- B2C invoices: Not required via Peppol. You can continue sending invoices to consumers by email, PDF, or paper.

In this article

1. The rules at a glance

| B2B (business to business) | B2C (business to consumer) | |

|---|---|---|

| Peppol mandatory? | Yes, since Jan 1, 2026 | No |

| Format | Structured e-invoice (UBL via Peppol) | Any format (PDF, paper, email) |

| Recipient must accept? | Yes, businesses must be able to receive | Consumer can refuse e-invoice |

| VAT number required? | Both parties have VAT numbers | Only the seller |

| Delivery channel | Peppol network | Email, post, portal, app |

2. B2B e-invoicing obligations

Every invoice between two VAT-registered Belgian businesses must be sent as a structured e-invoice via the Peppol network. This is not optional. Both the sender and the receiver must be registered on Peppol.

Who must comply: All Belgian VAT-registered businesses, including sole proprietors, freelancers, BVs, NVs, and non-profits with VAT obligations.

What format: Invoices must be in UBL (Universal Business Language) format, delivered through the Peppol network. A PDF sent by email does not count as a valid e-invoice.

Receiving too: You must be able to receive e-invoices via Peppol, not just send them. This means you need to be registered on the Peppol network.

Exemptions for B2B

Small businesses under the VAT exemption scheme (kleine onderneming) are exempt from sending e-invoices. However, they must still be able to receive them. Read the full details in our guide on who is and isn't required to use Peppol.

3. B2C invoicing rules

Invoices sent to individual consumers (private persons without a VAT number) are not covered by the Peppol mandate. You can continue to send these however you like.

Allowed for B2C

- PDF by email

- Paper invoice by post

- Invoice via a customer portal

- E-invoice via Peppol (voluntary)

Good to know

- Consumers cannot be forced to accept e-invoices

- B2C invoices still need all legally required fields

- You can send B2C invoices via Peppol if the consumer agrees

Important: the distinction is based on the recipient, not your business type. If you run a B2C webshop but occasionally sell to a company with a VAT number, that specific invoice must go through Peppol.

4. What if you sell to both B2B and B2C?

Many businesses serve both audiences. A restaurant may invoice corporate events (B2B) and serve walk-in customers (B2C). A web agency may have business clients and the occasional private customer.

The rule is simple: look at each invoice individually.

Invoice to a company (with VAT number)

Must be sent via Peppol as a structured e-invoice. No exceptions.

Invoice to a private person (no VAT number)

Can be sent in any format. PDF, paper, or email are all fine.

Practical tip

If you have a mix of B2B and B2C customers, consider using a platform like e-invoice.be for all your invoicing. Send B2B invoices via Peppol automatically, and use the same tool to create simple invoices or PDFs for your B2C customers. One workflow for everything.

5. Key differences between B2B and B2C invoices

Beyond the Peppol requirement, there are several other differences between B2B and B2C invoices in Belgium.

| Aspect | B2B invoice | B2C invoice |

|---|---|---|

| Invoice mandatory? | Always required | Only for certain sectors (e.g. construction, car sales) |

| Delivery via Peppol | Mandatory (2026) | Optional |

| Buyer VAT number on invoice | Required | Not applicable |

| VAT reverse charge | Possible (e.g. construction, intra-EU) | Not applicable |

| Simplified invoice allowed? | No (full invoice required) | Yes, for amounts under €400 |

| 120% tax deduction | Yes, for e-invoicing costs | Not applicable |

6. Where is the EU heading?

The European Commission's ViDA (VAT in the Digital Age) proposal aims to make e-invoicing standard across all EU member states by 2030. Currently, the focus is on B2B transactions. B2C e-invoicing is not yet part of the EU mandate.

However, several countries are already moving in that direction. Italy requires e-invoicing for both B2B and B2C since 2019. Getting set up for B2B e-invoicing now means you will be ready when the scope expands. For a full overview of which countries require Peppol, see our country-by-country guide.

7. Frequently asked questions

Do I need Peppol for B2C invoices?

No. The Belgian e-invoicing mandate only applies to B2B transactions. You can send B2C invoices in any format you prefer.

What if my customer has both a VAT number and is a private person?

If the transaction is for business purposes and the customer provides a VAT number, it is a B2B invoice and must go through Peppol. If they are buying as a private person, it is B2C.

Can I send B2C invoices via Peppol voluntarily?

Yes, if the consumer agrees to receive e-invoices. Some businesses choose to do this for consistency. But the consumer always has the right to request a traditional invoice instead.

I only have B2C customers. Do I need to register for Peppol?

If you are VAT-registered, you still need to be able to receive e-invoices via Peppol. Your suppliers may send you invoices through the Peppol network. So yes, you should register for Peppol to be able to receive.

What about B2G (business to government) invoices?

E-invoicing to Belgian government entities has been mandatory since 2024 for amounts over €3,000. These must also go through Peppol. So B2G follows the same rules as B2B (and was actually required earlier).

How do I get started with B2B e-invoicing?

Register with a Peppol Access Point like e-invoice.be. We handle the technical side. You can send e-invoices from our dashboard, upload PDFs for automatic conversion, or integrate via our API. See our registration guide to get started.

Ready for B2B e-invoicing?

Get compliant with the Belgian e-invoicing mandate. Free registration, no subscription, pay only per invoice sent. B2C invoices? You can create those too.